We are thrilled to again be named “Best Lawyer / Attorney or Firm” in Hopkins for a third year! We very much appreciate being a trusted member of this community and wider Minnesota. Berg Myers Law - A Hopkins, Minnesota institution since 1977!

When should I update my estate plan?

One of the more common questions we are asked as estate planning attorneys is, “when should I update my estate plan?” The simple answer is, whenever you have a substantial life event it is wise to review your plan to ensure that it still works with your goals.

There is a saying in the estate planning community that there are “Five D” life events that are reasons to review your estate plan. We’ve expanded on these “Five Ds” and added a bonus Sixth. These life events can be your own, or events in the life of someone you have nominated as an agent or beneficiary. Some are simple and self-explanatory, while others may be a little more complicated. Read on and find out if now is the time to schedule your own free estate plan review today.

Decade

Have a milestone birthday? Did the calendar change over to a new decade? These are great times to review your estate plan.

Death

The death of a beneficiary, nominated Personal Representative, or agent may mean that your estate plan should be updated. This can ensure that there are appropriate backups in place to act on your behalf or administer your estate, and that there are no complications or unintended distributions hidden in your estate plan.

Diagnosis

The diagnosis of an illness or disease is another compelling reason to review your plan. There may be new goals now and new planning necessary to achieve those goals. Similar to death, a diagnosis of an illness or disease for a beneficiary, nominated Personal Representative, or agent may be an appropriate time to review your own plan as well to ensure that a life changing diagnosis of theirs doesn’t change how you want your estate administered.

Decline

Like a new diagnosis, mental decline is certainly a reason to review your estate plan. Mental decline in yourself can change the goals for your estate planning. This may include planning for in-home care, assisted living, or Medical Assistance, all of which have different considerations when reviewing your plan. Decline in a nominated Personal Representative or other agent may mean that they are not an appropriate administrator for your affairs or estate. In a beneficiary, it may mean that their inheritance would jeopardize benefits that they may be entitled to. All of these are considerations when mental decline is confirmed or suspected.

Divorce

A divorce, or marriage, is certainly an important time to review your plan. While a marriage will certainly change aspects of your estate plan, a divorce can have hidden complications. A divorce generally extinguishes a former spouse’s claim to an inheritance under a Will but there are other provisions that may need to be addressed. Some questions to consider:

· Are there any specific gifts that were left to your former spouse’s family members?

· Were one of their family members named as Successor Personal Representative, Trustee, Medical Agent, or Attorney-in-Fact?

· Is a portion of the residue of your estate left to your former spouse’s relatives?

If your divorce was amicable and you would like your former spouse to continue to be a part of your estate plan, you will need to specifically include them again after the divorce is finalized. If your divorce was acrimonious and you have children together, perhaps you do not want your former spouse to be the custodian of any funds that would be left to your children. That should be specifically stated as well.

While these are important considerations if you go through a divorce, if one of your beneficiaries goes through a divorce, you should verify that your goals for gifting to them are unaffected. This is especially important if there are children involved or if a former spouse is named as a contingent beneficiary or Trustee.

Distribution – The bonus “Sixth D”

Did you receive an inheritance or other windfall that has changed your financial outlook? Depending on the amount or type of asset, a new estate planning strategy may be necessary. For 2023 the Minnesota estate tax exemption is $3 million per individual and the Federal exemption $12.92 million. This means anything in your estate that is above those thresholds is subject to the estate tax and estate tax mitigation planning may be necessary.

While these asset levels are aspirational for most of us, smaller inheritances can also spur the need to change your plan. Do you need to change your beneficiary list or the dollar amount of specific gifts? Did you inherit property that you would like to sell, pass on in your plan, or turn into a family legacy property? An inheritance, whether expected or not, can be a good time to review your own estate plan.

Do any of these common situations sound familiar? If so, we can give you a free, no-obligation, consultation to review your estate plan to ensure it still achieves your goals. Whether we drafted your documents before or not, we are here to help.

- T. Corwin Myers V

Tom Myers recognized as a North Star Lawyer

I was very pleased earlier this month to receive this communication from the Minnesota State Bar Association:

The MSBA is pleased to recognize you as a North Star Lawyer. In 2021, 747 North Star Lawyers provided more than 81,000 hours of pro bono service to people of low income at no fee, for a total value of over $20 million in free legal services. This program exists to show that meeting the aspirational goal of 50 hours of pro bono work is possible, valuable, and appreciated. Thank you for your dedication to pro bono publico – work for the public good.

This recognition particularly makes me happy because it brings to mind the memory of my dad, Thomas III, who was Executive Director of the MSBA from 1959 (the year I was born) to 1966 (the year he passed away - I was barely 7 years old). I never knew my Dad as an adult, but I do remember our pride in his work there. Thanks, MSBA!

Posted by Thomas Myers 6/23/2022

Is the State Going to Take Everything? A 10,000 Foot Overview of the Probate Process

While there are many legal areas and processes that are misunderstood, perhaps none are more so than probate. Unfortunately, it is an undeniable fact that at some point, each of us will pass away. When that happens, someone will need to settle your affairs and, very likely, they will use one of the available probate processes to do so. Read on as we explore what probate is, what it is not, how it can be avoided, and how we can help through the process.

WHAT IS PROBATE?

At a basic level, probate is the process of settling a decedent’s probate-able estate after they pass away. This means determining what assets are considered probate versus those that are non-probate. Non-probate assets would be anything that can be transferred to a new owner without outside involvement. These include joint accounts, any financial accounts that have beneficiaries or pay-on-death designations, and real estate that is held jointly, or has a valid Transfer on Death Deed.

In contrast, probate eligible assets are those which are owned solely by the decedent and have no beneficiary or pay-on-death designations. Think of it as any asset that does not have an automatic mechanism to transfer to the new owner. Most often, transferring these requires judicial involvement through an appointed Personal Representative, who is the agent in charge of the decedent’s estate.

After a Personal Representative is appointed to the estate, either via nomination in the decedent’s Will, or petitioning the court, they have the authority to handle the Estate’s affairs. This includes gathering all the decedent’s probate assets, paying any valid debts, distributing any specific gifts made in a Will, and distributing the remaining assets, called the residue, to the appropriate beneficiaries. Because this can be a labor-intensive process, the Personal Representative has the option to be paid for their time out of estate assets. We can help the Personal Representative as much, or as little, as they prefer.

WHAT ARE SOME OF THE MISCONCEPTIONS OF PROBATE?

One of the most common misconceptions that we hear about the probate process is that if an estate ends up going through probate, the State is going to take as much of the proceeds of the estate that they can. While the State making a claim against an estate is possible, it is not as common as people think. The three most common claims that the State can assert on estate assets are Medical Assistance liens, unpaid State or Federal taxes, and Estate Taxes. While Medical Assistance liens and unpaid taxes are straightforward, it is the idea of Estate Taxes that have given the probate process the bad reputation that it has. Historically, in some jurisdictions, the State could make a claim to a portion of the decedent’s estate. However, currently the Minnesota Estate Tax is only applicable to those individuals whose assets are above $3 Million dollars (or $6 Million for a couple). Federally, that number jumps to $11.7 Million! These figures are subject to change via legislative action, so they are worth keeping in mind when crafting your estate plan. If your asset level warrants considering Estate Tax mitigation, there are options that can help reduce or eliminate the tax burden on your estate.

Another common misconception is that if a decedent had a Will, that it will help to avoid probate. Unfortunately, the simple act of executing a Will does not automatically mean that your estate will avoid probate after your passing. A Will is a document that gives you the opportunity to describe how you would like your estate to be administered after you pass.

There are four main functions of a basic Will. The first is the nomination of a Personal Representative, and often a backup or two. The second is a description of the authority that your Personal Representative has. The third is a description of any specific gifts of money or personal property that you would like to leave to beneficiaries. The fourth is a description of how you would like the residue of your estate to be distributed. Beyond these four functions, a Will can also name preferred Guardians and Conservators for minor children, how you would like any taxes paid, and if there are specific people you would like included, or excluded, from your estate. Unfortunately, none of these functions are effective in avoiding probate, but they do direct how you would like the probate process to be handled. Without that input, your estate will be administered according to the State’s probate statutes. That isn’t necessarily a bad thing, but it does leave a bit more work for the survivors that need to settle your estate.

PROBATE PROCESS

The probate process can apply to both those who pass away with a Will, or testate, and those who pass away without a Will, or intestate. In either case, one of the first actions is to determine who the appropriate Personal representative should be. For those who die testate, the Personal Representative should be nominated in the decedent’s Will. If the decedent died intestate, then an appropriate Personal Representative must petition the court to be appointed after showing that they are a sufficiently interested party. An interested party is often a close family member, but with the proper interest, virtually anyone can open the probate proceeding. This includes creditors! This is quite rare, but it can happen if the creditor determines that their interest is worth the time and effort of administering the decedent’s estate. Much more likely is the creditor submitting a claim against the decedent’s estate. Before moving on, any other interested parties must be identified. That generally includes any individuals or organizations that have the potential to receive a specific gift, or a portion of the estate’s residue.

After the potential Personal Representative and interested parties have been identified, the next step is to determine whether the probate should be conducted formally or informally. In Minnesota, the general processes are the same between both options. Both are commenced by submitting an application or petition to the probate registrar or judge in the county in which the decedent was domiciled at the time of their passing. The biggest difference between the two different processes is the judicial oversight required. Often, informal probate proceedings will be “unsupervised,” meaning that there is no continual oversight of the Personal Representative’s actions. By contrast, a formal probate can either be similarly “unsupervised,” or it can have additional oversight required in a “supervised” administration. Whether the probate is formal or informal, supervised or unsupervised, there will be a hearing on the application or the petition that will appoint the Personal Representative. The judge or registrar will issue Letters Testamentary if there is a Will, or Letters of General Administration if the decedent died intestate. These are colloquially referred to as the Letters, and they are the proof that the Personal Representative has the authority to act on behalf of the Estate.

After the Personal Representative has the Letters, they are able to open up an estate bank account that will act as a repository for all of the decedent’s assets before they are distributed. This includes any assets that do not have a specific beneficiary. Bank accounts, insurance payouts, refund payments, petty cash, proceeds from the sale of the decedent’s personal items, or real property sales all get deposited into the account. Once all the decedent’s assets are gathered into one place, the Personal Representative must compile an Inventory of all the assets that the decedent had at the time of their passing. After the Inventory is created, the Personal Representative must determine what valid debts and bills need to be paid. Most jurisdictions, including Minnesota, have a hierarchy of payments to help the Personal Representative determine the order in which debts and bills should be paid. Look for an upcoming blog post about the priority of payments and creditor’s claims.

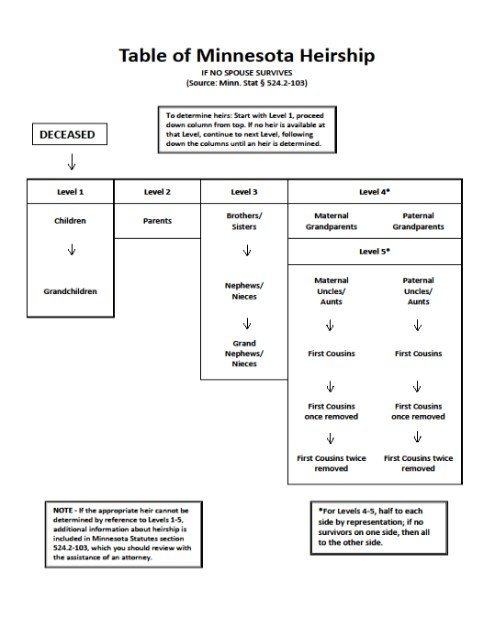

After the bills and debts have been paid, the Personal Representative’s next step is to distribute any specific monetary or personal property gifts that the decedent has left in their Will. Anything left over after the bills, debts, and specific gifts have been distributed is considered the residue of the estate. If the decedent left a Will, it generally directs the Personal Representative how to distribute the residue. If the decedent died intestate, the Personal Representative distributes the residue equally to the closest living relatives. This determination is made by consulting the jurisdiction’s Table of Heirship. Minnesota’s Table of Heirship can be found at the end of this post. If the probate is formal and supervised, the Personal Representative will need to have the supervising judge approve any distributions before they are made. In an informal proceeding, this approval is not necessary.

Once the Personal Representative has finished all the steps to this point, they must create a Final Accounting. This Final Accounting is one of the last steps to take before filing the documents to close the estate and have the Personal Representative discharged and relieved of their duties.

AVOIDING PROBATE

For tips on how to avoid probate via estate planning, check out this blog post by Schuyler Tilson-Doheny. If it is too late to mitigate the risk of probate through estate planning, there are a few things that can be done.

HOW CAN WE HELP?

If this overview of the probate process seems a bit complex, that’s because it is! We help everyone from those who have never interacted with the legal system to other lawyers, and everyone in between. We have dealt with everything from the most straightforward estate to multi-year and multi-generational probate cases. Our philosophy is to help Personal Representatives and interested parties in whatever capacity and at whatever level they need help. We can handle virtually every step of the way for the Personal Representative, or we can be more hands-off to keep the cost of administration down.

Do you have more specific questions about your estate planning to help avoid probate? Call us today to set up a free, no obligation, consultation!

Please remember, this post provides educational information only and in no way constitutes legal advice.

Source: https://www.ag.state.mn.us/consumer/handbooks/probate/TableofHeirship.pdf

Senior Partner Tom Myers returns as a guest on “Tuesdays with Ted" - Senior Services Real Estate pro Ted Field’s popular webcast.

Senior Partner Tom Myers was once again a guest on “Tuesdays with Ted" - Senior Services Real Estate pro Ted Field’s popular webcast.

On 10/5/2021, Tom and Ted discussed the probate process, how it can be beneficial, and how it can be avoided. Watch here!

We are moving effective November 1, 2021!

Greetings to our new and existing clients! Effective November 1, 2021, we will be moving to a new, more accessible and updated facility. We will be in the Gateway Building at 9800 Bren Road, Suite 290, Hopkins, MN 55343. All of our phone and other contact information will remain the same.

We’ll now be very easy to find - just take the Bren Road exist off of Hwy. 169, then very briefly jog right (West) and then immediate right on Smetana - first building on the right. Or, from downtown Hopkins, take 11th Avenue South to Smetana, then left (East) on Smetana. Follow around the curve towards Bren - we will be the last building on the left.

Suite 290 is on the main entry floor, and is wheelchair accessible by ramp from the parking area.

We hope to see you soon!

Farewell to Sr. Associate Attorney Schuyler Tilson-Doheny

For the last three years, we have had the great pleasure and honor to work with the highly talented Schuyler Tilson-Doheny. Schuyler, a William Mitchell graduate and former Senior Staff Attorney with the Ho-Chunk Nation Trial Court, came to us in August, 2018. Schuyler immediately fit in to our practice and began providing truly excellent service to our clients, quickly becoming our Senior Associate Attorney. Her compassion for client needs and unfettered competence will be greatly missed. However, even though Schuyler’s daily presence will no longer be with us, she remains a “member of our family” as an of counsel attorney with the firm. Schuyler’s professional life next takes her to Legacy Title, a full-service title insurance and real estate closing company. We’ll will miss you Schuyler!

Senior Partner Tom Myers was a guest on “Tuesdays with Ted" - Senior Services Real Estate pro Ted Field’s popular webcast.

On 7/15/2021, Senior Partner Tom Myers was a guest on the popular “Tuesdays with Ted” weekly Webcast. Tom and Ted discussed a recent complex real estate sale, and significantly cover the wide range of services Ted provides to seniors who have reached a transition-from-home point in their journey. Watch here!

The Things We Can (still!) Control

January 15, 2021 update:

[Note from Tom Myers: I first published this blog post early in the Covid (and many other fronts) crisis, in June of 2020. Who could have foreseen that the winds of change would continue to howl around us so ferociously! We are still here, and the message is still the same - let us know if we can help you get and maintain a bit of control, while so much is beyond it.

Our sincere thanks to our many loyal clients - new and decades-long alike - that have kept us going strong. we appreciate you greatly and it is humbling and rewarding to work with you and your families.]

************

June 3,2020

So much of our lives are out of our control right now, it’s easy to throw up your hands and stop trying. It may feel like there’s nothing much you can control or accomplish - that world and local events are sweeping around you and there’s nothing you can do.

However: there are a few institutions that are still standing strong, and there are steps you can take right now to assure that the most important events in your life can happen just the way you want them to - and that your wishes will be enforced with the weight of the law and the courts on your side.

Our state Probate Court system came to a temporary and brief halt, but it has now resumed, and it is adjudicating cases daily (although remotely.) Courts continue to enforce properly executed estate planning documents (such as Wills and Trusts), meaning that your wishes outweigh state-mandated Intestate (no Will) distribution statutes.

Our medical systems are functioning, and medical staffs continue to highly encourage all of us to have a Medical Directive on hand, meaning your care wishes outweigh standard operating procedures.

And, banking, financial institutions, and care facilities honor (and often require) validly executed Powers of Attorney so that loved ones can continue your critical life financial and business functions for you, even when you may not be able to do so yourself.

We have set up procedures to quickly and easily complete these documents that are so critical to controlling the things you can control. We use remote technology, phone and video guidance, and “outside of the box” methods such as sidewalk care facility visits, curbside signing with safe-distance witnessing, and doorway / garage signings to make sure your documents are quickly and accurately completed, with minimum danger or trouble to you. We’re small enough to accomplish these signings, including witnessing and notarization, while still getting to know you personally, and while coming to you no matter what your circumstances.

And, we continue our long-standing practice of secure storage of an extra original of all of your critical documents, in case you or your family need a copy. (We recently heard from a client’s son that desperately needed a copy of a document that was unavailable due to his parent’s quarantine at a senior living facility - he could not enter the facility to get mom’s document. We were happily able to supply a copy immediately, and at no charge.)

So let us know if we can help you! Details, pricing, and as always our free 1/2 hour initial consultations, are available with an easy phone call or e-mail, or just leave us a note in the contact us section, and we’ll contact you promptly to get started.

Thank you for your interest in Berg Myers Law! We hope to see you soon.

The Things We Can Control

[Note from Tom Myers: I first published this blog post early in the Covid (and many other fronts) crisis, in June of 2020. Who could have foreseen that the winds of change would continue to howl around us so ferociously! We are still here, and the message is still the same - let us know if we can help you get and maintain a bit of control, while so much is beyond it.]

Our sincere thanks to our many loyal clients - new and decades-long alike - that have kept us going strong. We appreciate you greatly and it is humbling and rewarding to work with you and your families.]

*************

So much of our lives are out of our control right now, it’s easy to throw up your hands and stop trying. It may feel like there’s nothing much you can control or accomplish - that world and local events are sweeping around you and there’s nothing you can do.

However: there are a few institutions that are still standing strong, and there are steps you can take right now to assure that the most important events in your life can happen just the way you want them to - and that your wishes will be enforced with the weight of the law and the courts on your side.

Our state Probate Court system came to a temporary and brief halt, but it has now resumed, and it is adjudicating cases daily (although remotely.) Courts continue to enforce properly executed estate planning documents (such as Wills and Trusts), meaning that your wishes outweigh state-mandated Intestate (no Will) distribution statutes.

Our medical systems are functioning, and medical staffs continue to highly encourage all of us to have a Medical Directive on hand, meaning your care wishes outweigh standard operating procedures.

And, banking, financial institutions, and care facilities honor (and often require) validly executed Powers of Attorney so that loved ones can continue your critical life financial and business functions for you, even when you may not be able to do so yourself.

We have set up procedures to quickly and easily complete these documents that are so critical to controlling the things you can control. We use remote technology, phone and video guidance, and “outside of the box” methods such as sidewalk care facility visits, curbside signing with safe-distance witnessing, and doorway / garage signings to make sure your documents are quickly and accurately completed, with minimum danger or trouble to you. We’re small enough to accomplish these signings, including witnessing and notarization, while still getting to know you personally, and while coming to you no matter what your circumstances.

And, we continue our long-standing practice of secure storage of an extra original of all of your critical documents, in case you or your family need a copy. (We recently heard from a client’s son that desperately needed a copy of a document that was unavailable due to his parent’s quarantine at a senior living facility - he could not enter the facility to get mom’s document. We were happily able to supply a copy immediately, and at no charge.)

So let us know if we can help you! Details, pricing, and as always our free 1/2 hour initial consultations, are available with an easy phone call or e-mail, or just leave us a note in the contact us section, and we’ll contact you promptly to get started.

Thank you for your interest in Berg Myers Law! We hope to see you soon.

Berg Myers Voted 2020 Best Attorney/Lawyer in Hopkins by Readers of the Local Newspaper, Sun Sailor!

Three Strategies for Avoiding Probate in Minnesota

One of the most frequent questions we get asked by our estate planning clients is how they can avoid the necessity of probating their estate. They want their estate to be administered by their families in as easy a way as possible without needing to go to probate court. An estate needs to be probated in Minnesota when there are assets that are in the deceased person’s name alone and the total amount of those assets exceeds $75,000. Here is a brief summary of the three most common strategies for avoiding probate:

1. Set up a trust and transfer all your property into the title of the trust.

Trusts can either be set up immediately, or through your Will - called a ‘Testamentary Trust.’ The main benefit of setting up a trust through your Will is that there is less work for you to do on the front end. However, the burden falls on your personal representative/trustee to do the bulk of the work to establish the trust on the back end. A trust that is set up immediately requires you to do a significant amount of work on the front end to fund the trust by retitling assets, such as bank accounts or your home, into the name of the trust. However, it is less work and expense for your personal representative after you die. The best option for you should be discussed with an estate planning attorney.

Note: Transferring your home into the name of the trust through a quit claim deed may accelerate your mortgage and trigger the “due on sale” clause. Executing a Transfer on Death Deed could be a better strategy if you have a mortgage on your house. (see section 2.)

2. Execute a Transfer on Death Deed for Real Property

A Transfer on Death Deed (TODD) effectively transfers property that you own to the person that you designate in the deed upon your death. That person would simply need to take a certified copy of your death certificate and an Affidavit of Identity and Survivorship to the county recorder’s office to have the property transferred into their name. (This could be combined with Section 1, where you execute a TODD that transfers the home into the trust upon your death.)

3. Add Payable on Death Designations and Joint Owners

Probate is only required for assets that you own in your name alone and that do not have beneficiaries. On certain types of assets, such as investment accounts, IRAs and 401k’s, you can designate who should receive that asset upon your death. Make sure that the beneficiaries on these types of assets are up to date – you probably wouldn’t want assets going to a former spouse simply because you forgot to change the beneficiary!

You can also designate who you want to receive the funds from bank accounts by filing Payable on Death (POD) forms with your bank. (Each financial institution has their own form for this.) Your POD beneficiary would be able to access the funds after your death by bringing in a certified copy of your death certificate to the bank. An alternate method is to add a joint owner to the account. This could be problematic though as your bank account could be considered part of their assets. In addition, that person would have immediate access to your funds without your permission or approval. Filing a POD form and executing a durable Power of Attorney would allow for the bank account to be transferred to the designated person upon your death while also allowing them to access your bank account when you become incapacitated.

Note: A durable Power of Attorney is effective immediately when it is signed and not only when you become incapacitated. However, you can execute a Power of Attorney and keep it with your important documents for your loved one to access upon your incapacity. They can’t utilize the Power of Attorney unless you give the executed document to them.

Posted by Schuyler A. Tilson-Doheny

Please remember, this post provides educational information only and in no way constitutes legal or tax advice.

The Intersection of Estate Planning and Probate Law (Or: Your Wishes Become the Law.)

It’s easy to understate the relationship between Estate Planning and Probate Law: Estate Planning involves planning your eventual inability to speak for yourself. Probate law takes over when the ultimate inability to speak for yourself takes over - your passing from this life. (This assumes certain circumstances, such as assets left behind in your name alone.) But this simple relationship underscores something profound:

Estate Planning and the Law

We, through our probate laws, have built a system that not only allows us to express our wishes beyond our ability to speak for ourselves, but also enforces those wishes with the full power of our justice system. Properly created, your Estate Planning documents become “law” unto themselves, which a judge will enforce on your behalf.

If you Die or Become Incapacitated without Properly Documenting your Wishes, the Statutes will Decide for You.

If you pass away in Minnesota without a Will or Trust, Minnesota statutes determine who will inherit your estate (“estate” meaning, generally, all assets which your leave behind.) See Minnesota Statutes 524,101. Your assets will pass by operation of law to your surviving spouse, children, and/or nearest classifications of relatives in statutorily defined shares and amounts. This statutory distribution may or may not be what you would have intended. In one example that we often hear about: if you have a long-time partner that you are not married to, there is generally no provision in the law that will provide assets to them. Without estate planning documents that provide otherwise, all of your assets will pass to your next closest of kin. Similarly, if you become incapacitated (e.g. serious chronic memory issues or traumatic brain injury), absent a properly drafted Power of Attorney and Health Care Directive, a costly Guardianship proceeding may be required in order for a loved one to establish the legal authority to speak for you.

If you have properly-drafted estate planning documents in place, your wishes have the force of law.

Within limits, if you have left behind a properly drafted and executed Will or Trust agreement, your wishes take priority over what would otherwise be a statute-driven asset distribution. See Minnesota Statutes 524.101. Under Minnesota law, you may not entirely disinherit your spouse and children. See Minnesota Statutes 524,402, 524,403, and 524.404. But absent that limitation, assuming proper drafting and execution of your estate planning documents, you can decide:

Who inherits your assets (your “Beneficiaries”)

Who administers your estate (your “Personal Representative”, previously known as “your Executor”. “Estate Administration” generally means taking control of your assets, paying valid costs and claims on your behalf, and distributing your remaining assets (your “residuary estate”) as you have detailed in your estate planning documents.)

Who has legal authority to continue or complete your personal business transactions (your “Attorney in Fact” under a Power of Attorney)

Who has the authority to speak for you regarding medical decisions (your “Health Care Agent”; also having the authority to review your medical records.)

See our handy guide: Estate Planning Legal Toolkit for a one-page overview.

The Probate Court will Enforce Your Wishes

If Probate is required at your passing, a presiding Probate Registrar or Judge will “admit” your Will to Probate, and directly oversee the administration of your estate. This means that, assuming properly documented estate planning documents and within the limitations sited above, your wishes have the power of law. In the Probate Court setting, the judge will “probate” your Will, meaning that it will be adjudged and authenticated as your witnessed and notarized Last Will and Testament. From that point forward, the court will oversee and approve that your wishes are properly administered (followed through on) by the Personal Representative that you have nominated in your Will. Even in an Unsupervised Informal Probate, your Personal Representative must provide, in a sworn Personal Representative’s Statement to Close, that all of your wishes as stated in your estate planning documents have been fulfilled. Any person wishing to contest or argue your wishes must make their case, formally, in front of the judge. Your estate planning documents have the force of law. A judge will enforce your properly stated wishes as contained in your estate planning documents.

Posted by Thomas C. Myers IV

Please remember, this post provides educational information only and in no way constitutes legal advice.

A Case for Tribal Probate Courts

Sovereignty is the ability of a people to be self-governing. It is a society making its own laws reflective of its people. Courts play pivotal roles in sovereignty as part of self-governance is the system in which laws are enforced. Probate courts are microscopes, magnifying the values of a community and a family. Through these proceedings we see what items held value to a person. We learn about the relationships between family members and their past difficulties. Tribal probate courts can strengthen tribal sovereignty and self-governance by upholding the values of the community.

The purpose of probate is to have a neutral third party make a determination about the final disposition of a deceased loved one’s property in light of that person’s written and witnessed intent. The downside to these court proceedings is often the cost and time involved, as well as the further degradation it can cause to familial ties. Nonetheless, it is useful to have disputes settled by a disinterested party. Some turn to mediators or qualified neutrals to settle these issues. However, all parties must agree to those arrangements and be held to the result. For others, getting a court involved is the only way to finally get resolution and closure. Probate courts decide how to interpret a decedent’s intent and uphold the values of the community as codified by the probate code. Determining which family member inherits property when there is no will or trust is often decided by intestate succession sections of the code.

Currently, the Minnesota Uniform Probate Code mandates that the entire estate (other than the homestead, exempt estates, and allowances) go to a spouse if the decedent had children and the decedent’s spouse is the parent of all of those children. Minn. Stat. Sec. 524.2-102. Otherwise, the spouse is entitled to “$225,000 plus one-half of any balance of the intestate estate” if the decedent had children that were not legally adopted or biological children of the decedent’s spouse. Id. The intent behind this law is most likely to ensure that the children of the deceased are provided for and that a step-parent is prevented from taking the entirety of the decedent’s property. It assumes that the spouse would take care of the children financially if the spouse were the parent of the children of the deceased. This intestate succession law demonstrates the values that are promulgated in the Minnesota state judicial system. Intestate succession laws can be different in a community where children are viewed as being the responsibility of a parent’s partner regardless of legal adoption or biological parentage.

Judicial officers who preside over probate hearings must reflect the values of the community just as do probate codes. A judge or referee who does not have a background or understanding of the community can view the parties through a discolored lens. Take an intestate state court probate case that, among other issues, involves a question of who should inherit a spoon. To a judge who is not from or familiar with the community, it seems that this spoon is a piece of tangible personal property that should be distributed according to the intestate succession laws of Minnesota. It comes to light during the proceedings that this spoon is a ceremonial spoon that has been passed down for generations and that custom dictates who should inherit the spoon. The chain of custom can be broken if the person who is supposed to traditionally inherit is different than who inherits under the intestate succession distribution scheme. The state court judge’s hands are tied without a validly executed testate document, such as a Will, to supersede the intestacy laws.

Tribal communities can enact, and have enacted, probate codes that specifically separate out ceremonial items from being passed down the way of other property. Ensuring that these items stay with the people who are meant to traditionally keep them enables customs to be maintained and bolsters tribal sovereignty. Tribal probate courts are therefore pivotal in furthering tribal sovereignty. This is merely one of the reasons why legal professionals and community members should encourage the funding and establishment of tribal probate courts.

Posted by Schuyler Tilson-Doheny

Please remember, this post provides educational information only and in no way constitutes legal advice.

What To Do After a Loved One Dies

Here are 10 of the most common steps we often advise our clients to take soon after a loved one passes away:

Look for a Will, Trust Agreement, and Health Care Directive where they kept important documents.

Contact your loved one’s estate planning attorney if you can’t find the originals of these documents.

Their Will should state who they nominated as their Personal Representative or Executor - this is the person who is responsible for handling your loved one’s financial affairs.

Arrange for funeral, burial, and cremation services based on the instructions in their Health Care Directive or Will.

Often the funeral home will arrange for an obituary unless you request that one is not posted.

Order at least 8 certified copies of the death certificate.

Determine the extent of their assets and debts.

Assets include properties, bank accounts, IRAs, insurance policies, and personal property (vehicles, art, etc.).

Debts include mortgages, loans, credit cards, and liens.

Assess whether any of their assets had beneficiary or payable on death designations by contacting the financial institutions.

You will need to present a certified copy of the death certificate to the financial institution.

Some institutions will not discuss a deceased loved one’s financial matters unless you show them Letters Testamentary (a court order that shows you were appointed as the personal representative) or an Affidavit of Collection for Small Estates (only used in Minnesota when the entire probate estate is less than $75,000.)

Consult with an estate planning attorney to determine whether your loved one’s estate needs to be probated (administered in court).

Secure their property by changing the locks on the house, maintaining the home, and collecting the mail.

Contact the Social Security Administration and any other agency they received benefits from to inform the agency of your loved one’s passing.

Obtain an Employer Identification Number and open an estate bank account if necessary.

Pay your loved one’s bills using their assets if you are the personal representative/executor.

Some estates may be considered exempt from creditors’ claims - consulting with an estate planning/probate attorney will determine whether this is the case for your loved one’s estate.

Posted by Schuyler Tilson-Doheny

Please remember, this post provides educational information only and in no way constitutes legal advice.

How Do I Avoid Probate?

This question is often asked when a new client visits with us after a recent death of a friend or family member. "Is there any way around this?" "Do I really have to go through this process?"

Probate is often required under the law. See this link to understand what a probate administration entails. Minnesota’s probate statutes are in place to ensure that the decedent's property goes to the appropriate heirs or beneficiaries. Sometimes, a probate proceeding is required to help determine who the heirs are and what they should receive of the deceased person's assets.

Let's use the following example to outline a couple of ways probate can be avoided. Bob passes away and has no other assets other than (1) jointly held bank accounts with his spouse Jean, (2) Bob's retirement accounts has Jean named as the primary beneficiary, and (3) Bob and Jean own their home jointly (called the "primary homestead"). All of these assets are considered "non-probate" because they have an identifiable beneficiary -- Jean.

1. Affidavit of Collection of Personal Property: When The Total Value of all "Probate" Assets are less than $75,000. If we change the above example just a bit and add an asset, e.g. an investment account worth $70,000 that is held in Bob's name alone and has no named beneficiary. This is considered a "probate asset" because Bob has not named who he wants to receive this account. This alone would not trigger a probate, however. Jean, as the surviving spouse, would be able to "avoid" probate by having her attorney draft an Affidavit of Collection of Personal Property. The state of Minnesota permits heirs to collect assets without the need for a full-blown probate proceeding if they can prove their right to inherit and provide this signed affidavit along with a certified copy of the decedent's death certificate to the financial institution where the account is held.

2. Summary Distribution: When the Only Probate Asset is the Primary Homestead. There are a number of legal requirements that must be met to qualify for this type of proceeding which we will not go into here, but it is available at times when the only asset is the decedent's primary place of residence. If Bob owned the home in his name alone (Jean is not on the title with him) and there are virtually no other "probate assets", then there is a shortened administrative proceeding that can be used to get the home transferred to Jean because the homestead is considered an asset that is exempt from all creditors (except for any mortgages on the property and/or Medical Assistance claims).

3. Proper Planning Prior to Death! This is a bit tongue-in-cheek, but if one takes the time to consider where they want their assets to go at their death then it takes very little additional effort to make the necessary changes to avoid the need for a probate. If we again adjust the original example above and add in Bob's investment account but assume it has $100,000 in it rather than $70,000 (and remember that this account is held in the Bob's name only and has no named beneficiary), then that account becomes a "probate asset" and a probate proceeding is required under the law. If Bob and Jean had discussed their goals (e.g. avoid probate!) and financial inventory with an estate planning attorney and financial advisor before Bob's death, they would have learned that this asset needed a beneficiary designation in order to be considered "non-probate".

Please remember, this post provides educational information only and in no way constitutes legal advice.

What Happens to your Online Accounts When you Die?

If you pass away unexpectedly and have no plan for what happens to your online accounts (your "digital assets"), your Personal Representative may be left with a huge mess to sort out. A Personal Representative ("PR") is someone you designate in your Will to help settle your estate. They gather all your assets, pay bills/debts, and distribute those assets to family or whomever is designated under your Will.

So, what happens to your digital assets when you die? How does your PR gain access your email accounts, cloud storage, iTunes, PayPal, eBay, gaming profiles, etc? Here is a quick rundown of a potentially complicated situation:

Many Terms of Service (remember that long legal thing that you quickly clicked "I agree" to without reading?) expressly forbid access to anyone aside from the account holder. This is because of strong federal privacy laws.

Your PR will have to reach out to each company directly (call up Google, Apple, eBay, etc) and prove your death. Once proven, email and social media accounts will likely simply be shut down and deleted without giving the PR any access to the actual content of the accounts. For some things, that's okay. For other things, not so much (like a PayPal account with $30,000 left in it!). Accounts like these end up in virtual limbo, not to mention are sitting ducks for hackers.

To gain access to the data itself (such as cloud storage), your PR could easily be required to get a court order to obtain the information. Who knows how lengthy and costly of a process this can be.

Okay, you get it. It's a mess. So, what can you do about it? Plan!

Minnesota recently passed the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). This Act provides a bridge between the rights of your fiduciary (like a PR) to step into your shoes and the federal privacy laws. This law enables a fiduciary to do what they need to do without additional headache of getting court orders as described above.

Create and maintain an orderly list of usernames and the associated email addresses. Or utilize a company like EstateMap, which charge a minimal fee and securely store this information for you. You appoint someone to gain access to this account upon your death.

Ensure that your attorney drafts language into your Will (and Power of Attorney, Trust documents, etc) about how to deal with digital assets (e.g. expressly authorizing your PR to access, modify, control, archive, transfer, and delete digital assets).

Additionally, some companies (like Facebook) are providing an online tool for you to appoint a "Legacy contact" on your account which allows this person access to your account upon your death. You can get directions on how to set this up here: Facebook Help Center. Similarly, Google allows you to designate an "Inactive Account Manager" that gets activated after a certain number of months of no activity on your account.

Regardless of what you do to back up your passwords, be it on paper, on your computer, or on an app, just do SOMETHING! And most importantly, account for it in your estate plan. Specific language should be in every Will or Trust, stating you expressly authorize your Personal Representative (or Trustee or other Fiduciary) to access your digital assets for enumerated purposes. It is just another way to ease the burden on friends and family that have to put your affairs in order after death.

Please remember, this post provides educational information only and in no way constitutes legal advice.

Reviewing Beneficiary Designations is Important. Here's Why.

Take a minute and imagine the following scenario: your ex-spouse was listed as beneficiary on a long-forgotten life insurance policy through a former employer that you haven't reviewed in 5 or 10 years. You are now re-married with two minor children. If circumstances led to your untimely passing, the funds from that policy may not go to your children or spouse. It may go directly to your ex-spouse. (While there is a law in Minnesota that allows for automatic revocation of beneficiary designation upon divorce, there are important exceptions which I won't go into here. Better to be safe than sorry.)

Whether or not you have a Will or estate plan in place, reviewing your beneficiary designations every few years is always a good idea. It is the easiest way to ensure that these assets transfer to the individuals you want to inherit them. Maybe you never got around to listing anyone as a beneficiary. Maybe you had a child, got a divorce, or otherwise want to remove the person currently listed as a beneficiary.

By "Beneficiary Designations", I'm referring to those accounts or insurance policies (often called non-probate assets) in which you can choose who receives the benefits of the account in the event of your death. Some common examples include qualified retirement plans (such as 401(k) or 403(b) plans), IRAs, and life insurance policies. For each of these types of accounts, you can name a primary and contingent beneficiary (or beneficiaries). Upon your death, the assets in the account are distributed to the primary beneficiary unless they died before you. In that case, the contingent beneficiary would receive the assets instead.

Bottom line: take the time to review your beneficiary designations each time you review your estate plan or a significant life event occurs. It only takes a few minutes but it can have a significant impact on your loved ones.

Here are a few other potential mistakes to watch out for:

- Listing a parent as beneficiary after getting married and having children.

- Not having a contingent or secondary beneficiary.

- Naming a minor (or even a young adult) directly as a beneficiary instead of a trust for their benefit.

- Designating a trust that does not exist or is outdated as beneficiary.

Please remember, this post provides educational information only and in no way constitutes legal advice.